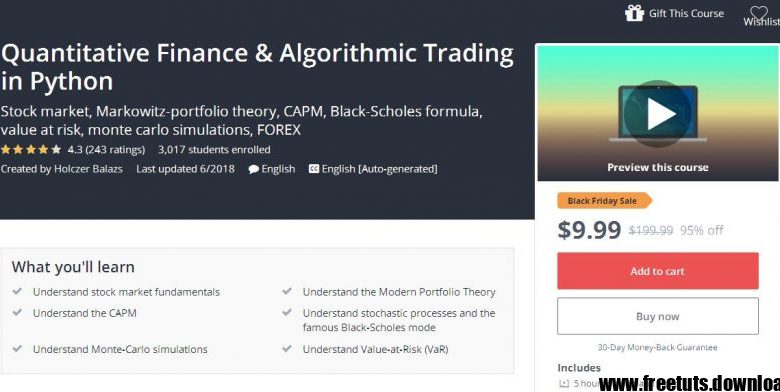

Quantitative Finance & Algorithmic Trading in Python

Stock market, Markowitz-portfolio theory, CAPM, Black-Scholes formula, value at risk, monte carlo simulations, FOREX Free Download

- Understand stock market fundamentals

- Understand the Modern Portfolio Theory

- Understand the CAPM

- Understand stochastic processes and the famous Black-Scholes mode

- Understand Monte-Carlo simulations

- Understand Value-at-Risk (VaR)

- You should have an interest in quantitative finance as well as in mathematics and programming!

This course is about the fundamental basics of financial engineering. First of all you will learn about stocks, bonds and other derivatives. The main reason of this course is to get a better understanding of mathematical models concerning the finance in the main. Markowitz-model is the first step. Then Capital Asset Pricing Model (CAPM). One of the most elegant scientific discoveries in the 20th century is the Black-Scholes model: how to eliminate risk with hedging. Nowadays machine learning techniques are becoming more and more popular. So you will learn about regression, SVM and tree based approaches.

IMPORTANT: only take this course, if you are interested in statistics and mathematics !!!

Section 1:

- installing Python

- stock market basics

Section 2:

- what are bonds

- how to calculate the price of a bond

Section 3:

- what is modern portfolio theory (Markowitz-model)

- efficient frontier and capital allocation line

- sharpe ratio

Section 4:

- what is capital asset pricing model (CAPM)

- beta value and market risk

Section 5:

- derivatives basics

- options (put and call options)

- random behaviour

- stochastic calculus and Ito’s lemma

- brownian motion

- Black-Scholes model

Section 6:

- what is value at risk (VaR)

- Monte-Carlo simulation

Section 7:

- machine learning in finance

- how to forecast future stock prices

- SVM, k-nearest neighbor classifier and logistic regression

Section 8:

- long term investing (the Warren Buffer way)

- efficient market hypothesis

Thanks for joining my course, let’s get started!

- Anyone who wants to learn the basics of financial engineering!

DownloadQuantitative Finance & Algorithmic Trading in Python Free Download Free

https://2speed.net/file/B8618F28099C

https://upfile.info/file/5ZPI99C63273

https://1fichier.com/?uhy91rdc34rm3htkooq9

https://drive.google.com/a/vimaru.vn/file/d/1xh1-7RrOYTfq_v_VQtZbQqe7KsI02bbP/view?usp=sharing

https://drive.google.com/a/vimaru.vn/file/d/1dCiTyHT2i2BI-j5PEiNZP53-HjAMJBUf/view?usp=sharing

https://uptobox.com/s84ym1cmhao8